tax shield formula cca

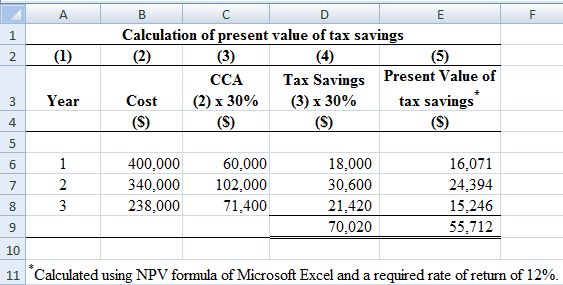

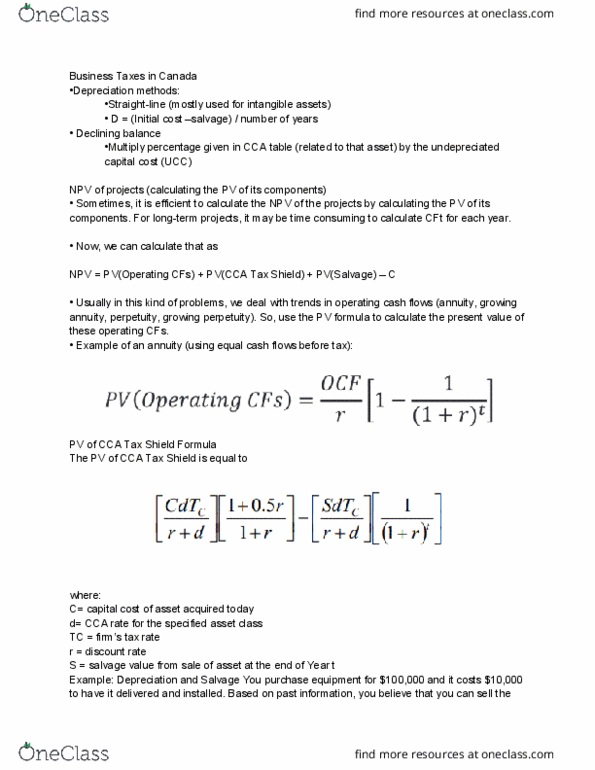

PRESENT VALUE OF TAX SHIELD FOR AMORTIZABLE ASSETS Present value of total tax shield from CCA for a new asset acquired after November 20 2018 𝐶𝑑𝑇 𝑑𝑘 115𝑘 1𝑘 Notation for. The value of a tax shield is calculated as the amount of the taxable expense multiplied by the tax rate.

Tax Shield Formula How To Calculate Tax Shield With Example

2815 W Sunset Blvd 201 SunsetOccidental Los Angeles CA 90026.

. Thus if the tax rate is 21 and the business has Last Update. Please visit our State of Emergency Tax Relief page for additional. 8 115 200 Given the growth rate as -d we need the first payment to complete the formula.

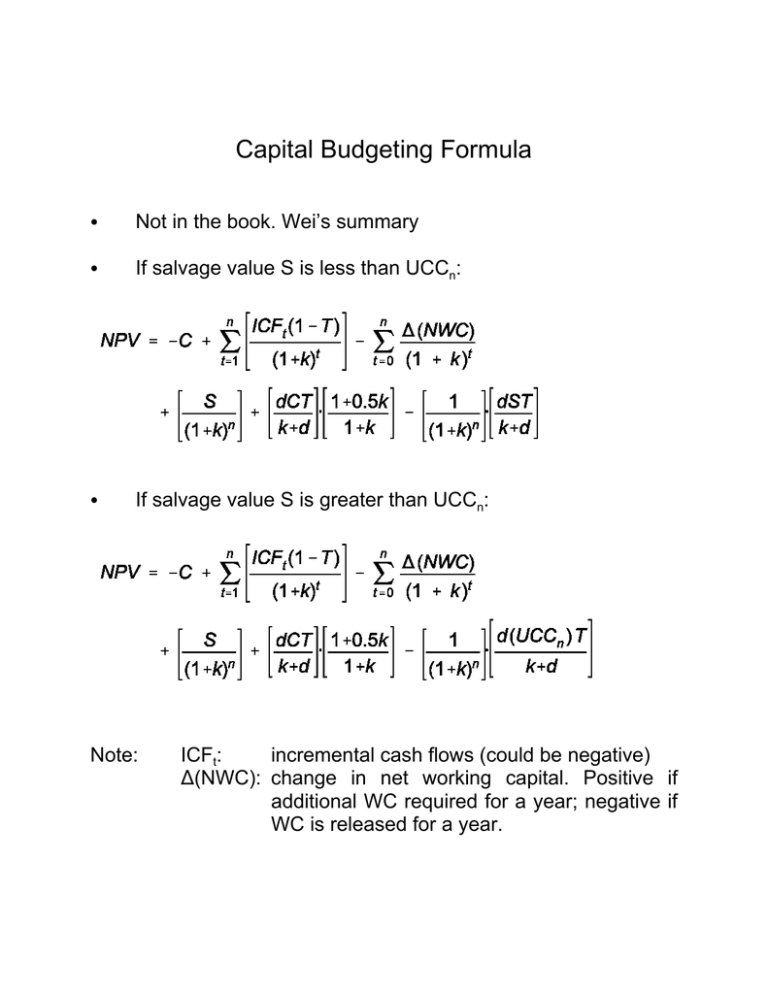

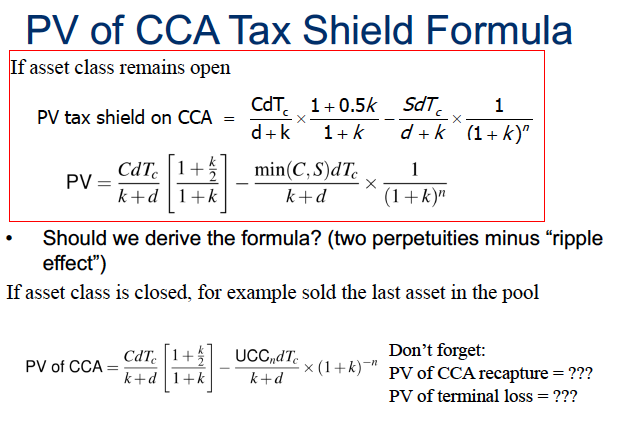

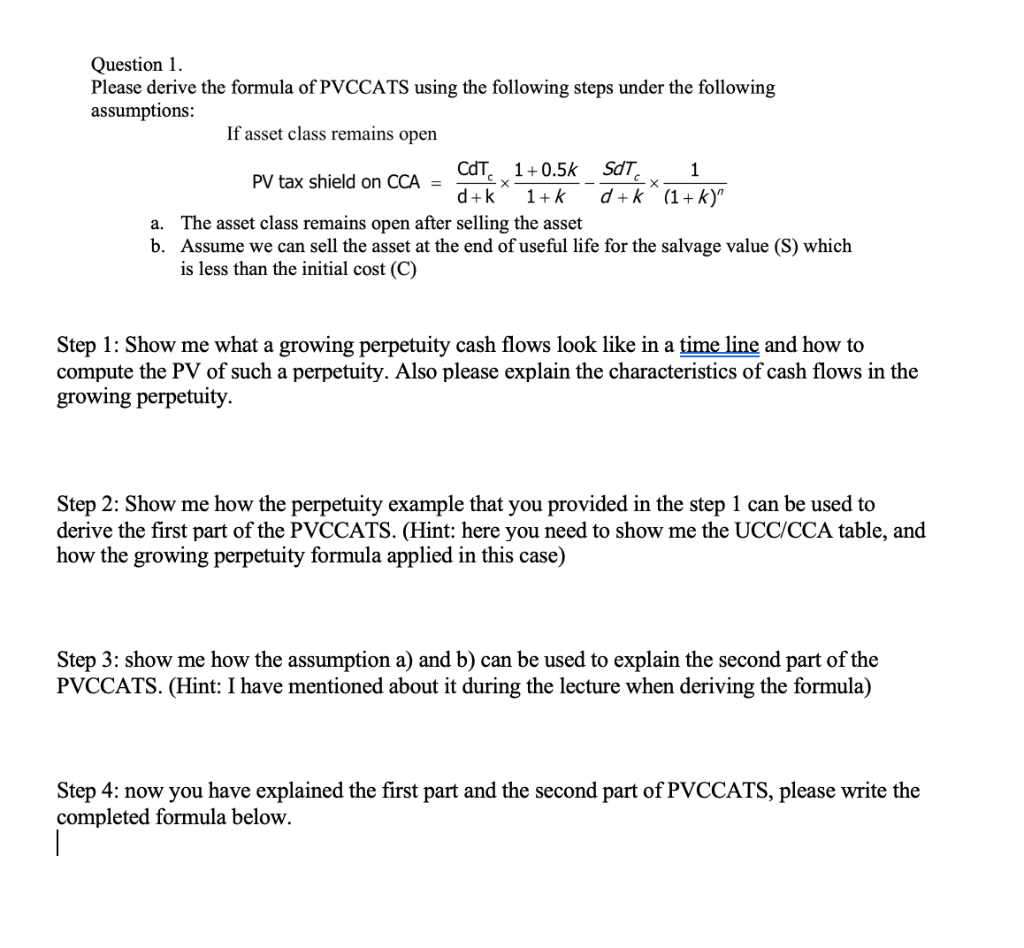

800 963-8008 TTY 711 Reach us seven days a week 8 am. File a return make a payment or check your refund. Weis summary C If salvage value S is less than UCC n.

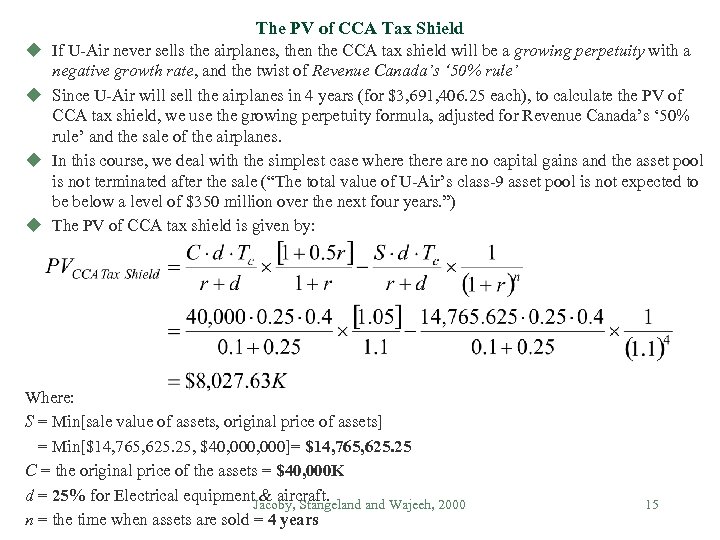

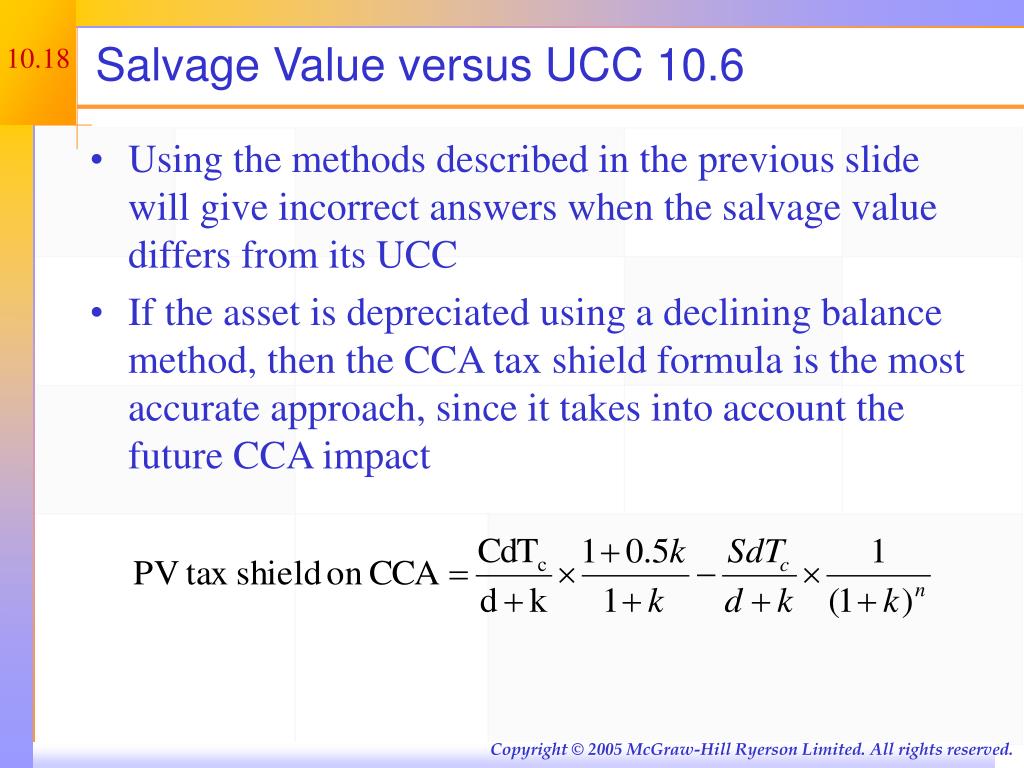

This companys tax savings is equivalent to the interest payment multiplied by the tax rate. Log in to your MyFTB account. Salvage Value versus UCC Using the methods described in the pro-forma statements will give incorrect answers when the salvage value differs from its UCC If the asset is depreciated.

California Franchise Tax Board. A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest. Read The Full Article.

Businesses impacted by recent California fires may qualify for extensions tax relief and more. This is the first years tax shield calculating the CCA at rate d on the total cost of the asset. That is why we dont have that line CCA tax.

As such the shield is 8000000 x 10 x 35 280000. Follow the links to popular topics online services. This is equivalent to the 800000.

Capital Budgeting Formula C Not in the book. Download View Cca Tax Shield Formula as PDF for free. C If salvage value S is greater than UCC n.

Blue Shield of California is an independent member of the Blue Shield Association. Uniform Final Exomination Report TABLE - 1997 125 III A FORMULA FOR.

Chapter 13b Solutions Managerial Accounting Tenth Canadian Edition 10th Edition Chegg Com

Depreciation Tax Shield Formula Examples How To Calculate

How To Npv Tax Shield Salvage Value Youtube

Chapter Mcgraw Hill Ryerson C 2013 Mcgraw Hill Ryerson Limited Making Capital Investment Decisions Prepared By Anne Inglis Edited By William Rentz Ppt Download

Solved Class Cca Rate Description 43 30 Machine And Equipment To Manufacture And Process Goods For Sale Tax Shield Formula Initial Investment X C Course Hero

Chapter 7 Capital Budgeting Npv U Recall

Midterm Formula Sheet 1 Comm370 Formula Sheet Efn Assets Debt Sales Sales P Studocu

Acc 372 Solutions To Problem Set 2

Ppt Making Capital Investment Decisions Powerpoint Presentation Free Download Id 3750664

Calculate Present Value Of Interest Tax Shield 16 3 Youtube

Fina 2710 Textbook Notes Summer 2019 Chapter 9 Tax Shield Net Present Value Working Capital

Edit This Is All The Information Provided It Is Chegg Com

Chapter 10 Practice Chapter 10 Questions And Problems Basic Questions 1 34 Relevant Cash Flows Studocu

Solved Question 1 Please Derive The Formula Of Pvccats Chegg Com

Capital Budgeting Formula Pdf Free Download

Tax Shield Issues In Finance Business 2039 Tax Shield Issues In Finance 1 Tax Shield Benefits For Studocu